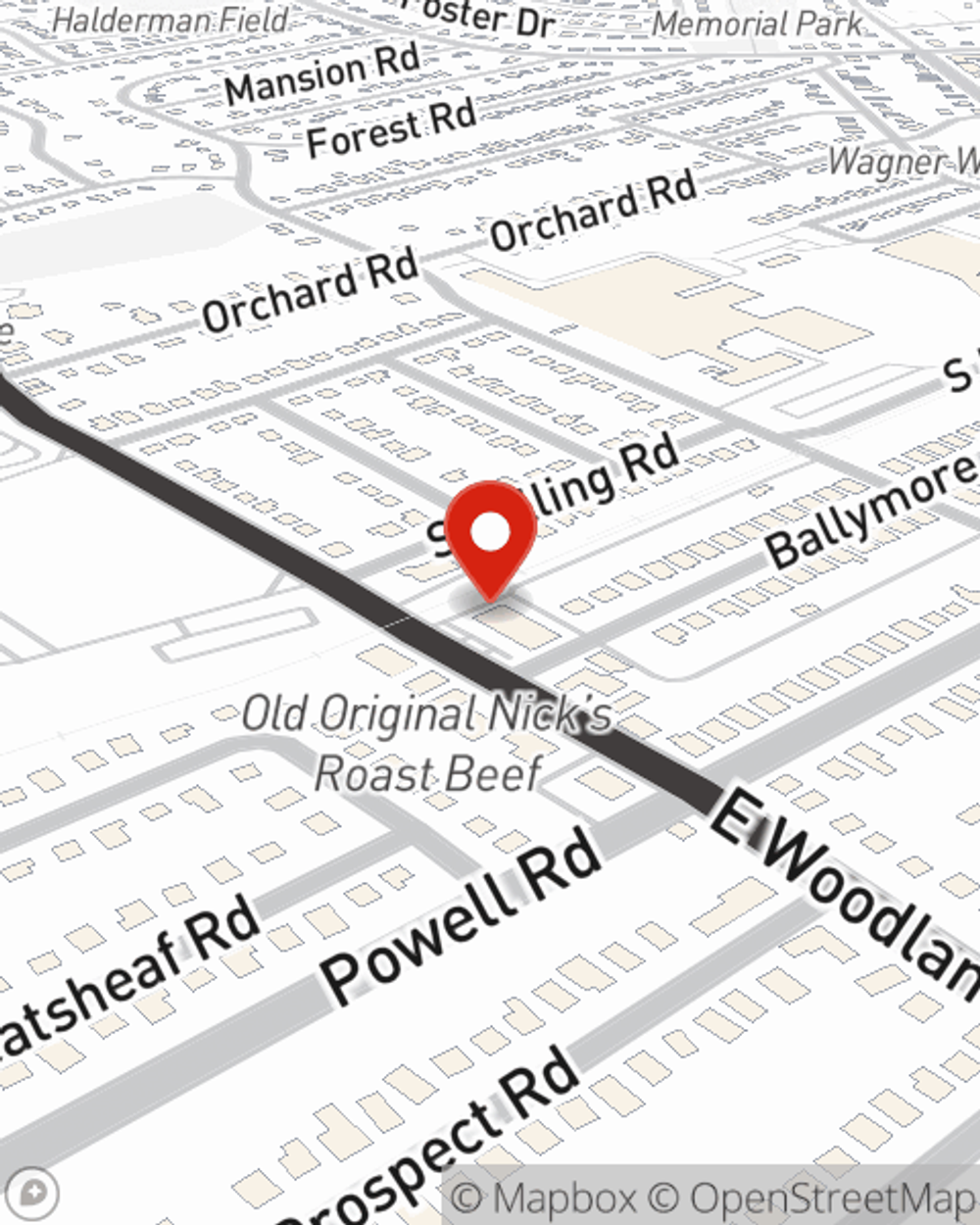

Business Insurance in and around Springfield

Get your Springfield business covered, right here!

Cover all the bases for your small business

- Springfield, PA

- Delaware County, PA

- Media, PA

- Broomall, PA

- King of Prussia, PA

- Bryn Mawr, PA

- Philadelphia, PA

- Newtown Square, PA

- Ridley, PA

- Wallingford, PA

- Swarthmore, PA

- Chester County

- New Castle, DE

- Conshohocken, PA

- New Jersey

- Havertown, PA

- Main Line

- Delco

- Lower Merion, PA

- Drexel Hill, PA

- Delaware

- Ridley Park, PA

- Gladwyne, PA

- Secane, PA

Insure The Business You've Built.

Preparation is key for when an accident happens on your business's property like a customer stumbling and falling.

Get your Springfield business covered, right here!

Cover all the bases for your small business

Customizable Coverage For Your Business

The unexpected is, well, unexpected, but that's all the more reason to be prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or business continuity plans, that can be created to develop a personalized policy to fit your small business's needs. And when the unexpected does occur, agent Jeff DiBlasi can also help you file your claim.

So, take the responsible next step for your business and call or email State Farm agent Jeff DiBlasi to investigate your small business insurance options!

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Jeff DiBlasi

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?